Why are some AI companies keeping 95% of customers while others lose half each year?

The AI market topped $135 billion in 2024, but behind the hype lies a critical metric that separates winners from losers: customer retention. This post breaks down actual retention rates across AI sectors and shows what top-performing vendors do differently.

Customer Retention: The True Health Metric for AI Vendors

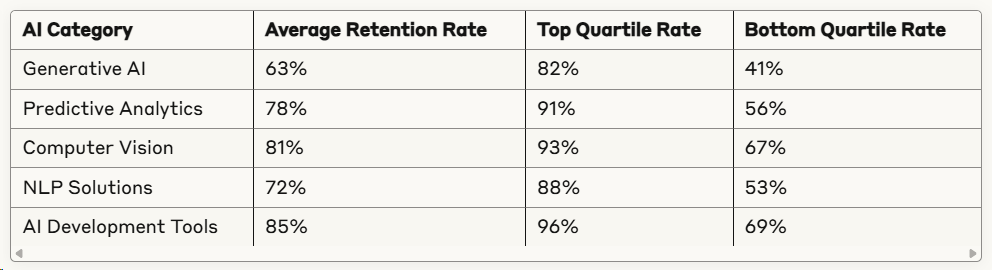

While venture funding and revenue growth grab headlines, retention rates reveal the real story about AI product effectiveness. The data shows dramatic differences across AI categories:

Key insight: The gap between best and worst performers in each category exceeds 25 percentage points, suggesting retention isn’t category-dependent but execution-dependent.

Why Customers Leave AI Vendors

Research from over 500 companies that switched AI providers reveals these top reasons:

- ROI failure (43%) – No measurable business impact after implementation

- Integration complexity (28%) – Too difficult to connect with existing systems

- Scaling issues (24%) – Solutions that worked for pilots failed at enterprise scale

- Support quality (19%) – Inadequate technical assistance after purchase

- Cost increases (17%) – Unexpected pricing changes after initial contract

What Top-Retention AI Vendors Do Differently

The AI companies maintaining 90%+ retention rates share these practices:

1. Faster Time-to-Value

High-retention vendors get customers to first value in under 30 days, compared to 90+ days for low-retention competitors.

Practical application: Leading vendors build implementation roadmaps with clear 7-day, 30-day, and 90-day value milestones.

2. Usage-Based Health Scoring

Top performers track product usage patterns that correlate with renewal:

- User activation rate (% of purchased seats actively using the product)

- Feature adoption breadth (number of features regularly used)

- Business process integration (how deeply embedded in workflows)

Practical application: They intervene when usage metrics drop, not just when renewal approaches.

3. Customer Success Investment

Companies with high retention invest 12-15% of revenue in customer success teams versus 5-7% for low-retention vendors.

Practical application: These teams focus on business outcomes, not just technical implementation.

4. Continuous Value Demonstration

The best vendors regularly quantify their impact with metrics that matter to decision-makers.

Practical application: Quarterly business reviews include clear ROI calculations showing the financial impact of the AI solution.

5. Educational Content Strategy

High-retention vendors provide 3-5× more educational resources than low-retention competitors.

Practical application: They create role-specific training that helps users advance their careers through platform expertise.

Case Study: How One AI Vendor Transformed Their Retention

A mid-sized machine learning platform was losing 40% of customers annually. After implementing these changes:

- Built a customer health scoring system based on usage patterns

- Created a 21-day onboarding program with clear success milestones

- Established quarterly business reviews focused on quantifiable outcomes

- Developed role-specific certification programs for users

Results after 12 months:

- Retention improved from 60% to 83%

- Expansion revenue increased by 47%

- Customer acquisition cost payback period decreased by 35%

Industry-Specific Retention Patterns

Retention rates vary significantly by customer industry:

- Financial Services: 84% average retention (highest)

- Healthcare: 79% average retention

- Retail: 71% average retention

- Education: 65% average retention (lowest)

Key insight: Industries with clearer ROI measurement show higher retention, suggesting the importance of quantifiable outcomes.

The Renewal Warning Signs Smart Vendors Monitor

Top-performing AI companies watch for these early indicators of churn risk:

- Executive sponsor changes – 71% correlation with non-renewal

- Reduced login frequency – 68% correlation when drops exceed 40%

- Support ticket sentiment – 63% correlation when negative feedback increases

- Feature adoption plateau – 59% correlation when users stop exploring new capabilities

- Declining API call volume – 57% correlation for embedded AI solutions

How to Evaluate AI Vendor Retention Before Buying

If you’re selecting an AI vendor, ask these questions to assess retention health:

- “What’s your annual customer retention rate for companies similar to ours?”

- “Can you share anonymous case studies of customers who’ve been with you 3+ years?”

- “How do you measure customer health post-implementation?”

- “What percentage of your customers expand their usage after the initial purchase?”

- “How quickly do most customers reach initial ROI?”

The Bottom Line: What This Means For AI Leaders

The AI market will continue its rapid expansion, but the vendors who survive won’t necessarily be those with the most advanced technology. The winners will excel at helping customers extract measurable value from their AI investments.

For AI vendors, this means:

- Building customer success into the product, not just as an add-on service

- Investing in implementation acceleration and adoption tools

- Creating clear ROI measurement frameworks specific to each industry

- Establishing early warning systems for adoption issues

For AI buyers, this means:

- Prioritizing vendors with proven retention over those with cutting-edge features

- Setting clear success metrics before implementation begins

- Investing in internal change management to drive adoption

- Requiring regular business reviews focused on outcomes, not activities

The future belongs to AI companies that don’t just sell technology but deliver business transformation. Retention rates tell us which vendors are actually delivering on that promise.

Unlock your AI Edge — Free Content Creation Checklist

Get the exact AI-powered process to 10X your content output — blogs, emails, videos, and more — in half the time.

No fluff. No spam. Just real results with AI.