I’ll create a comprehensive post about AI tools for financial services compliance that follows your guidelines.

AI Tools for Financial Services Compliance: Streamlining Regulation Management

Still struggling with complex compliance requirements?

Financial regulations grow more complex every day. Manual compliance processes drain resources, increase error risk, and limit your team’s ability to focus on strategic work.

AI compliance tools offer a solution – but which ones actually deliver results? This guide walks you through the most effective AI compliance tools for financial services.

Why AI for Financial Compliance?

Financial institutions face mounting pressure from:

- Rapidly evolving regulatory landscapes

- Increasing compliance costs (15-20% of operational budgets)

- Growing penalties for non-compliance

- Competition from digital-first challengers

AI tools help by automating routine tasks, spotting issues humans might miss, and adapting quickly to new regulations.

Key AI Compliance Tools for Financial Services

1. Automated Regulatory Monitoring

What it does:

- Scans global regulatory sources continuously

- Flags relevant changes to your business

- Categorizes updates by impact level

- Provides summaries of new requirements

Benefits:

- 90% reduction in manual review time

- Near-zero missed regulatory changes

- Faster adaptation to new rules

- Better resource allocation

Leading solutions:

- IBM OpenPages

- NICE Actimize

- Ascent RegTech

- MetricStream

2. Intelligent Document Processing

What it does:

- Extracts data from unstructured documents

- Categorizes and routes compliance documents

- Flags missing or inconsistent information

- Maintains audit trails automatically

Benefits:

- 80% faster document processing

- Reduced manual data entry errors

- Structured data for analytics

- Improved auditability

Leading solutions:

- DataVisor

- Ocrolus

- Workfusion

- ABBYY

3. Transaction Monitoring & Fraud Detection

What it does:

- Monitors transactions in real-time

- Uses pattern recognition to spot anomalies

- Reduces false positives through machine learning

- Adapts to new fraud techniques automatically

Benefits:

- 60% fewer false alerts

- 40% increased detection of actual fraud

- Reduced investigative workload

- Enhanced customer experience

Leading solutions:

- ComplyAdvantage

- Feedzai

- Jumio

- Sift

4. KYC/AML Compliance Automation

What it does:

- Automates identity verification processes

- Screens against sanction/watchlists

- Performs ongoing due diligence

- Creates risk profiles based on behavior patterns

Benefits:

- 70% faster customer onboarding

- Reduction in manual review requirements

- More consistent application of standards

- Better detection of high-risk customers

Leading solutions:

- Trulioo

- Jumio

- LexisNexis Risk Solutions

- Fenergo

5. Conduct & Communication Surveillance

What it does:

- Monitors employee communications across channels

- Flags potential market abuse or insider trading

- Identifies problematic communication patterns

- Maintains compliance with recordkeeping requirements

Benefits:

- Proactive identification of conduct issues

- Reduced investigation time

- Enhanced supervision capabilities

- Protection against regulatory penalties

Leading solutions:

- Digital Reasoning

- Shield

- Smarsh

- Relativity Trace

Implementation Best Practices

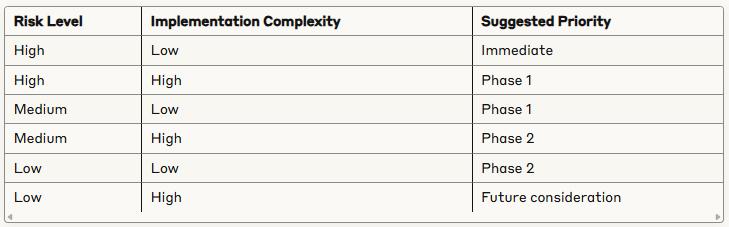

1. Prioritize Use Cases by Risk and ROI

2. Start with a Pilot Program

For successful AI implementation:

- Choose a specific compliance function with clear metrics

- Run the AI solution alongside existing processes

- Measure accuracy, efficiency, and staff feedback

- Use findings to refine full-scale implementation

3. Focus on Explainability

Regulators require understanding how compliance decisions are made:

- Select AI tools with transparent logic

- Document model training and decision factors

- Maintain human oversight of critical decisions

- Create clear audit trails for AI-assisted processes

4. Plan for Integration

Most financial institutions need their AI tools to work with:

- Legacy banking systems

- Existing compliance platforms

- Customer information databases

- Case management tools

Choose solutions with strong API capabilities and integration experience in financial services.

Measuring Success: Key Performance Indicators

Track these metrics to measure AI compliance tool effectiveness:

Efficiency Metrics:

- Processing time reduction (%)

- Staff hours saved per month

- Cases handled per analyst

- Time to complete regulatory filings

Quality Metrics:

- False positive reduction rate

- Issue detection improvement

- Error reduction in filings

- Regulatory examination findings

Financial Metrics:

- Compliance staffing costs

- Regulatory fine avoidance

- Technology ROI

- Customer acquisition improvements

Common Implementation Challenges

1. Data Quality Issues

Problem: Poor data quality undermines AI effectiveness. Solution: Conduct data quality assessment before implementation and clean data where necessary.

2. Staff Resistance

Problem: Compliance teams fear job replacement. Solution: Focus on how AI handles routine tasks while elevating staff to higher-value work.

3. Regulatory Uncertainty

Problem: Unclear guidance on AI use in compliance. Solution: Maintain human oversight and document all AI processes thoroughly.

4. Integration Complexity

Problem: Connecting AI tools with legacy systems. Solution: Choose vendors with experience in your technology stack and strong integration capabilities.

Getting Started: Your Action Plan

- Audit current compliance processes Identify bottlenecks, error-prone areas, and resource drains

- Define specific compliance objectives Set clear goals for what AI should accomplish

- Evaluate vendor expertise Look for financial services experience and regulatory knowledge

- Build a phased implementation roadmap Start with high-impact, lower-complexity applications

- Create a measurement framework Define how you’ll track success from day one

Final Thoughts

AI tools for financial compliance aren’t just about avoiding penalties—they transform compliance from a cost center to a competitive advantage. With the right implementation, these tools free your teams to focus on strategic work while improving regulatory outcomes.

The financial institutions seeing the greatest success don’t view AI as a replacement for human expertise but as an enhancement that makes their compliance professionals more effective, informed, and strategic.

By starting with clear objectives and measuring results carefully, you can build a compliance function that’s more robust, efficient, and ready for tomorrow’s regulatory challenges.

Unlock your AI Edge — Free Content Creation Checklist

Get the exact AI-powered process to 10X your content output — blogs, emails, videos, and more — in half the time.

No fluff. No spam. Just real results with AI.